Description

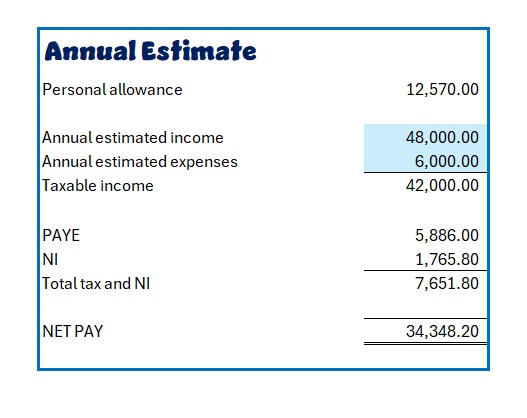

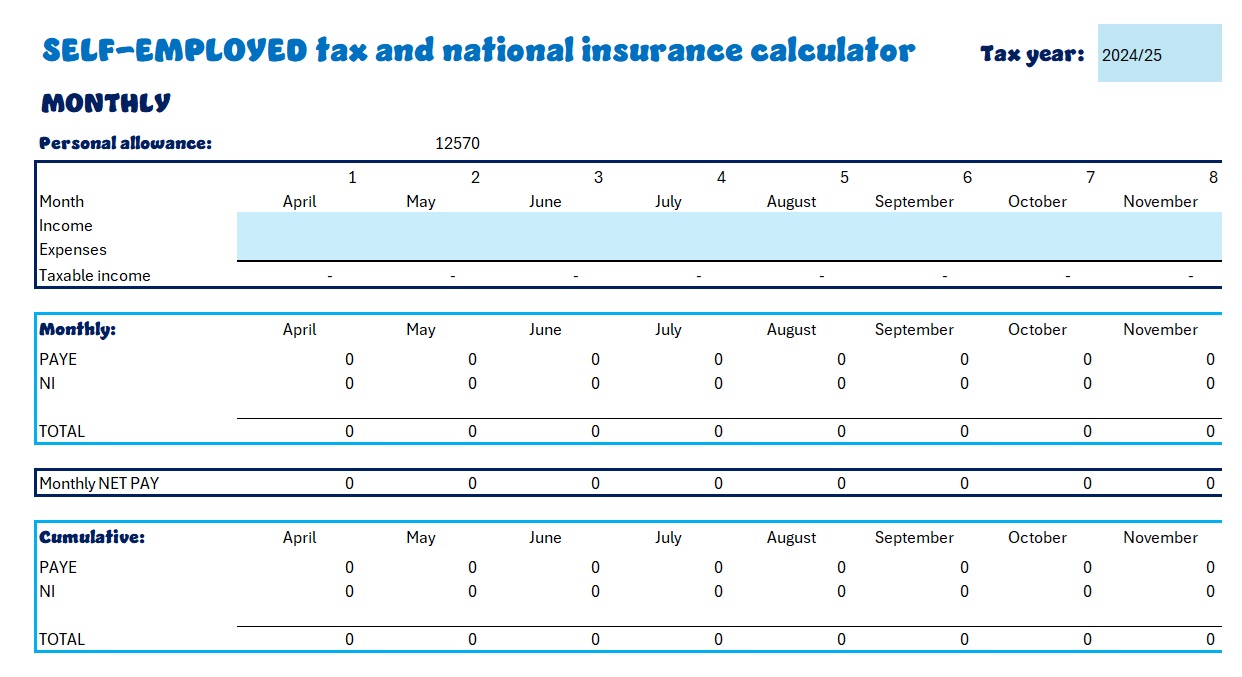

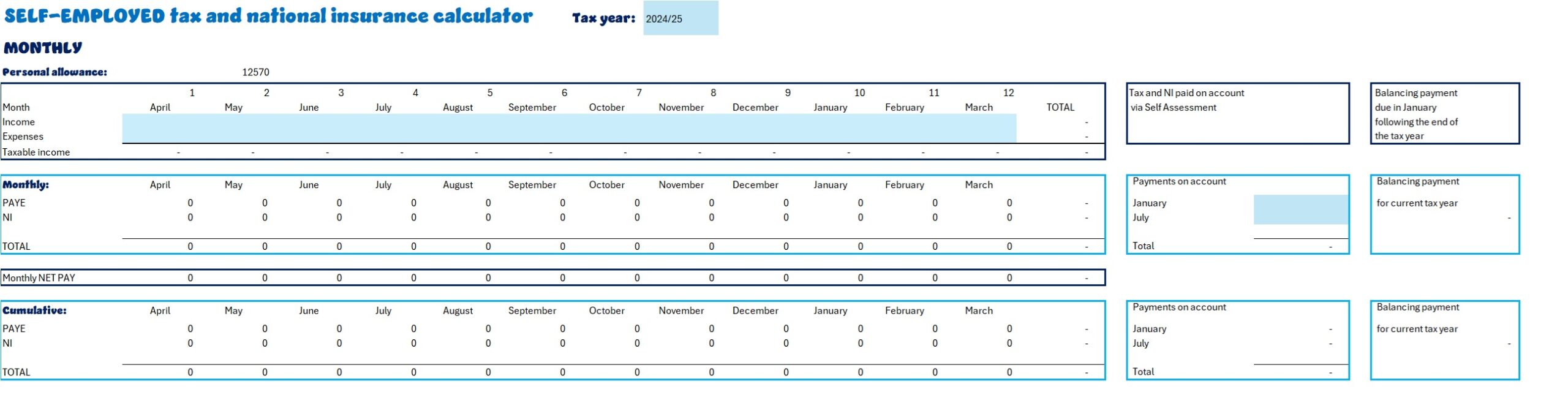

Keep track of your tax and national insurance liability during the year with this handy Excel Self-Employed Tax and National Insurance calculator for tax years from 2025/26. Suitable for self-employed individuals with a 1257L tax code and codes ending in L, P, T, Y, M and N resident in England, Wales and Northern Ireland. This Excel spreadsheet calculates monthly and cumulative tax and national insurance for self-employed individuals. The spreadsheet includes a section to enter self assessment payments on account. The spreadsheet also includes a calculator which provides an annual estimate of your potential tax and national insurance liability.

Reviews

There are no reviews yet.