Paying off your mortgage early

Paying off your mortgage early has several advantages, the most significant being reducing the interest paid over the life of the loan. Here are some suggestions to minimise your interest rate, reduce the amount of interest you pay and help you pay off your mortgage sooner:

- Pay more than the required mortgage payment every month – check that your mortgage terms and conditions permit overpayments. Some mortgages restrict overpayments and may charge fees if you overpay.

- Make sure you choose a mortgage with low or no early redemption fees (early settlement fees).

- When your fixed-rate mortgage term ends, shop around for a lower interest rate and consider re-mortgaging for more favourable terms.

- Consider taking a shorter term on the mortgage, such as a 20 year mortgage rather than 25 years. You can save interest over the life of the mortgage by decreasing the repayment period.

- Maximise your house deposit as you may be able to secure a lower interest rate, with a bigger deposit. Financial institutions view borrowers with larger deposits as less risky.

- Rent a room scheme – consider renting out a spare room for tax-free income.

The maths of paying more

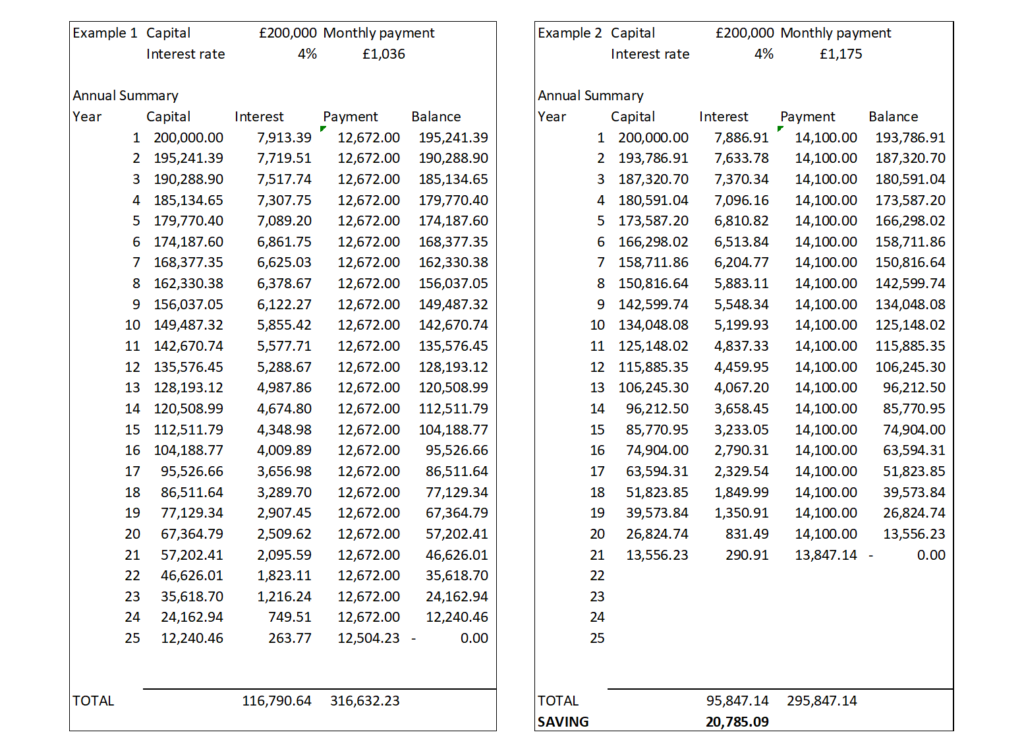

For those of you who are maths and figure-orientated, the chart below illustrates the savings you can make over the life of a mortgage by paying a little more every month.

When interest rates are low, the potential savings from making extra mortgage payments are not that high. When deciding whether to make extra mortgage payments, compare your mortgage interest rate to what you can earn elsewhere. When interest rates are low, you may earn more by saving the extra cash in a high-yield savings account paying a higher rate of interest than you are paying on your mortgage. Alternatively, consider investing in stocks to generate a higher return, but remember this comes with risk as stocks and share prices can go up or down in value.

However, when mortgage interest rates are high, making extra payments is usually the smarter choice as you can reduce the impact of compound interest on the debt. Ultimately, you need to consider your risk tolerance when choosing between these options.

Illustration

In the illustrations below, increasing the mortgage payment by £139 per month from £1,036 to £1,175 saves £20,785 in interest over the life of the mortgage. This settles the mortgage in 20.5 years rather than 25 years.

Mortgage payments are allocated between the monthly interest charge and the capital balance, or original loan amount. Overpayments are allocated against the capital reducing the outstanding balance. As the capital balance reduces, so does the interest charged on the capital. Over time, a higher percentage of the mortgage payment goes towards reducing the capital balance.

When mortgage interest rates are low

Let’s assume an outstanding mortgage balance of £150,000 with an interest rate of 2% and monthly repayments of £1,000. Increasing the monthly payment by £100 to £1,100 a month saves £11.06 in interest over the year whilst reducing the mortgage balance by an additional £1,200.

The alternative is to save £100 a month in a savings account paying 4% interest. At the end of the year, the savings account will have a balance of £1,226.32 having earned £26.32 in interest. Putting the money in a savings account yields £15.26 more than the interest saved on the mortgage.

Our shop has a handy mortgage calculator that lets you compare different mortgage values and interest rates. It’s a handy tool for comparing several mortgages from different lenders. You can also compare the interest savings and see how much sooner you can pay off your mortgage by paying a little extra each month.

Rent a room scheme – earn money from your home

Renting out a spare room lets you earn tax-free income from your home, providing extra money towards the mortgage and other running costs. With the rent a room scheme you can earn up to £7,500 a year tax-free, from renting out a furnished room in your home.

Income above the £7,500 allowance is taxable and must be declared on an annual self assessment tax return. You can register for self assessment via your HMRC personal and business tax account. If you don’t have a personal tax account, you can set one up using the following link:

Personal tax account: sign in or set up – GOV.UK (www.gov.uk)