Description

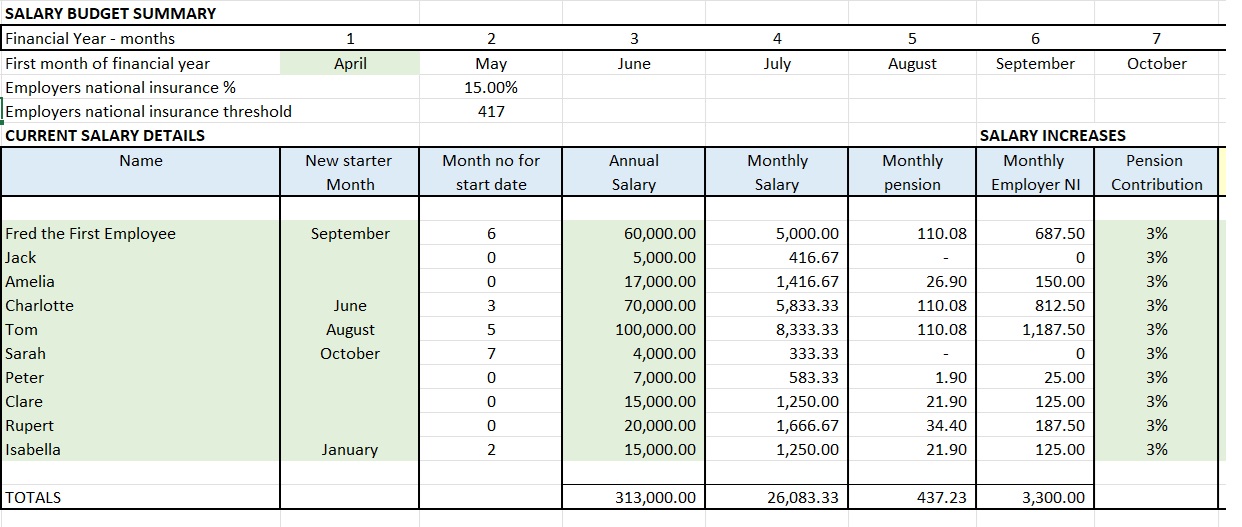

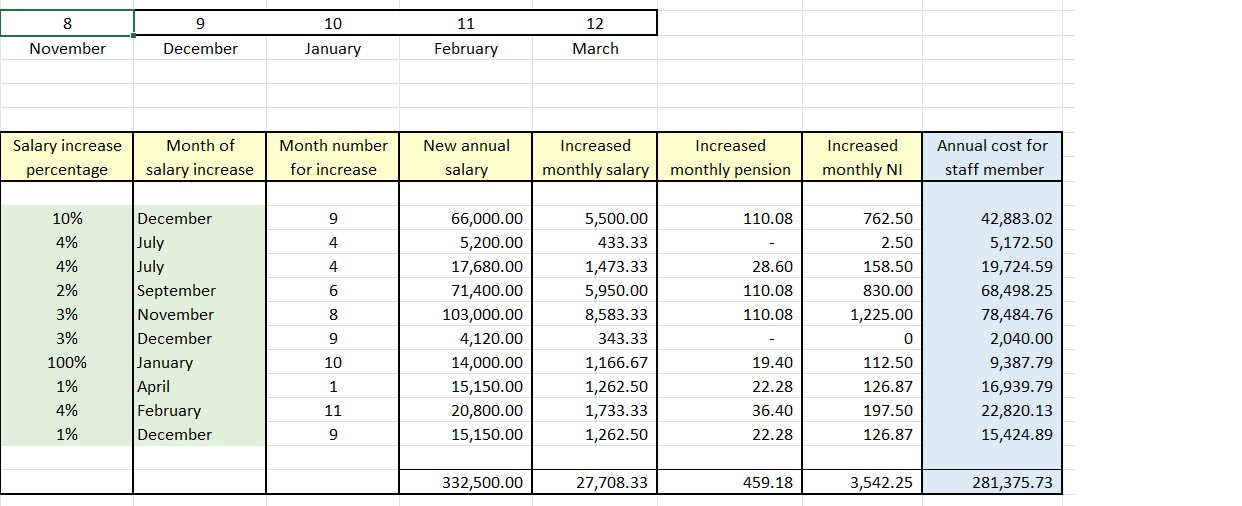

Downloadable Microsoft Excel file. Salary budgeting spreadsheet that calculates the monthly and annual salary expenses, employer’s national insurance and workplace pension contributions for up to 10 employees. Allows for one annual salary increase per employee at any month during the year. This product is suitable for use in the United Kingdom only.

With this product you can easily compute annual staff budget costs. The staff calculations are based on employer national insurance contributions of 15% and an employer NI threshold of £416 per month, which is effective for the tax year from April 2025.

The spreadsheet includes adjusted figures taking account of the employer national insurance of allowance of £10,500 where applicable. The spreadsheet also includes financial accounts figures and cash flow figures, to help you manage your cash flow more efficiently.

Pension contributions can be set up by employee, either as automatic enrolment pension contributions or contributions based on the entire salary. The spreadsheet includes a summary of the costs per employee.

The spreadsheet contains a field to enter the final month of employment for employees (note that the final month calculations are for the full month costs), allowing budgeting for contractors and temporary employees.

Reviews

There are no reviews yet.