Employment – Salary deductions

As part of your employment, your employer must give you a payslip with details of your pay deductions. It is your responsibility to check your payslip to make sure you’ve been paid correctly. Payroll mistakes can occur so understanding these deductions can help you spot any errors.

While we would all love to keep our full salary, His Majesty’s Revenue and Customs (aka HMRC) do require their share to keep the country running. Below is a list of the most common payroll deductions:

- TAX – PAYE (Pay as you Earn)

- National Insurance contributions

- Workplace pension (if you’re eligible)

- Student loan deductions (if you’ve been to university and have a student loan)

Your take-home pay (or net pay) is what’s left after the deductions. Budgeting your net pay helps you prioritise your expenses and build a regular savings habit, which is important for your long-term financial resilience.

When you start a new job, your employer will ask to see your passport or other form of identification. They will also need your national insurance number. If this is your first job, you will need to complete a new starter form which helps your employer determine your tax code. If it’s not your first job, you’ll need to give your new employer your P45, which is the form you receive from your previous employer when you leave. A P45 provides a summary of your salary and deductions to date, plus your tax code which determines how much you can earn before you pay tax.

UK individuals have an annual tax-free allowance of £12,570 or tax code of 1257L. You only pay tax on amounts you earn over this, meaning you can earn £1,048 a month tax-free. Your tax code for the current year may be adjusted if you paid too much or too little tax in previous years, which will affect your tax-free earnings allowance.

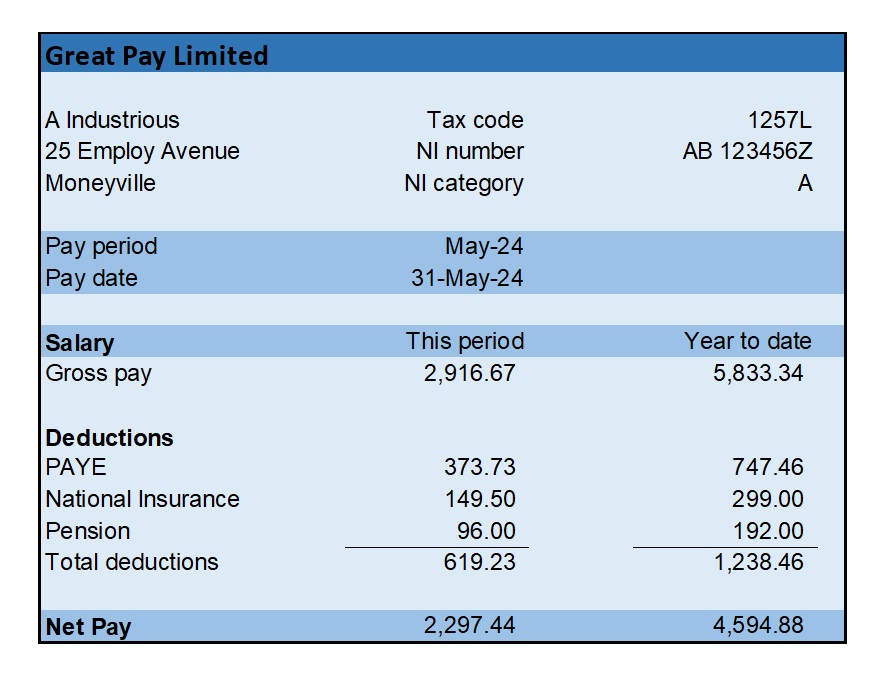

Below is an example of a payslip with standard deductions:

Use our net pay calculator to estimate your take home pay:

Employment deductions – the details

PAYE – Pay as You Earn

Your employer deducts PAYE (pay as you earn) or income tax from your salary. Most UK individuals have an annual personal tax allowance of £12,570 for the tax year. This means you can earn up to £12,570 and not pay any tax. This is also referred to as your tax code and is abbreviated as 1257L on your payslip.

The personal allowance is cumulative over the year, so in the first month of the tax year, you can earn £1,047.50 tax-free. Earnings above this amount are taxed at 20% if you fall within the basic tax rate band. In the second month of the tax year, you can again earn £1,047.50 tax-free or £2,095 cumulatively for the year tax-free.

Basic rate taxpayers, or someone earning up to £50,270 a year, will pay 20% tax on their income above £12,570. For example, if you earn £35,000 a year, your monthly tax will be £374. This is calculated as follows:

- Calculate the monthly pay (£35,000/12), which is £2,917

- Deduct 1/12th of the personal allowance (£12,570/12 = £1,048) from the monthly pay

- £2,917 less £1,048 equals £1,869 taxable income at 20%

- 20% of £1,859 = £374 monthly tax

To illustrate the cumulative impact of the personal tax allowance, if you only start working in the third month of the tax year, or June, your cumulative tax allowance is £3,142.50 (3 x £1,047.50). If your salary is £3,000 a month, you won’t pay any tax in June as you have earned less than your cumulative tax allowance to date. In July you will pay 20% tax on £1,810 (£3,000 less your monthly tax allowance of £1,047.50 less the remaining £142.50 of unused tax allowance from June = £1,810). The tax for July will be £362. In August, your tax will be £390, which is 20% of £1,952 (£3,000 less the monthly tax-free allowance of £1,048).

National Insurance

Employees pay Class 1 NI contributions, with the percentage rate of NI, determined by your NI category letter. Most employees have a category letter of A, paying NI of 8% on earnings over £1,048 and up to £4,189 a month. Earnings over £4,189 a month incur NI of 2%.

These bands are the NI thresholds. The monthly primary threshold is £1,048 and the upper earnings limit threshold is £4,189. For weekly paid earnings, these bands are £242 and £967. Staff paid weekly pay the same percentage rate as monthly paid employees.

Employees under 21 will have M as their NI letter and apprentices under 25 the letter H, paying NI at the same rate as letter A.

Pensions

Employers have a legal duty to automatically enrol eligible employees into a workplace pension scheme. Under automatic enrolment, your employer must pay a minimum of 3% of your salary into a pension. The minimum legal contribution to an auto-enrolment pension is 8% of earnings above £6,240 and up to £50,270. If your employer contributes 3%, you will need to contribute 5%. After the 2O% government tax relief, you only pay 4% of your earnings. Employees aged 22 years and over, earning £10,000 or more per annum must be automatically enrolled in a pension scheme. You do have the option to opt out of auto-enrolment, however, you forfeit the 3% contribution from your employer.

Some employers may have an alternative pension scheme outside of the auto-enrolment scheme. They will pay a percentage of your salary to the pension scheme with personal contributions optional. In this instance, your employer will explain the pension options to you.

The table below provides a breakdown of the calculation of the tax, NI and pension deductions for a monthly salary of £2,917 (£35,000 annual salary). After deducting the personal allowance and thresholds from the monthly salary of £2,917, the net amounts are multiplied by the applicable percentage rates for PAYE, NI and workplace pension. The deductions total £620, leaving a net pay of £2,297.

| Salary less PA & Thresholds | Thresholds | Net | Rate | Deductions |

|---|---|---|---|---|

| Tax (£2,917-£1,048) | £1,048 | £1,869 | 20% | £374 |

| NI (£2,917-£1,048) | £1,048 | £1,869 | 8% | £150 |

| Pension (£2,917-£520) | £520 | £2,397 | 4% | £96 |

| TOTAL | £620 |

Other employment stuff you need to know

As an employee, you have various employment rights, such as annual leave and minimum wages. Some employers may offer additional staff benefits. Learn about the core employment rights, how to register with HMRC for a personal tax account and tax rebates, using the links below.